| Topic: Job Creation and Stock Market - no correlations | |

|---|---|

|

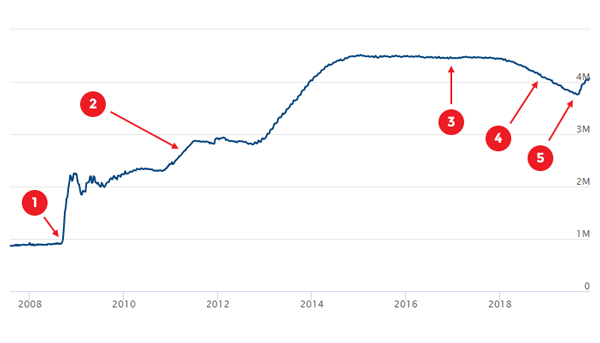

Cannot be sure whether this link is legit news - but worth a read. https://www.trump.news/2019-12-10-federal-reserve-balance-sheet-numbers-re-elect-trump-money-pumping.html The stock market is a rigged game, of course, and current stock prices don’t even reflect real corporate earnings. Instead, they most closely echo the rise and fall of quantitative easing, a form of artificial money creation by the Federal Reserve. The Fed uses its money creation powers to either boost presidents it wants to keep in power (like Clinton and Obama) or punish presidents it wants to see removed from power (like Trump, initially). The link is called “Recent balance sheet trends” and shows you the Fed’s balance sheet, in trillions of dollars, from July, 2007 through December, 2019. Follow the chart points below to understand exactly what the Fed is doing:

#1) Obama is inaugurated, so the Fed explodes the money supply and creates over a trillion in new assets for itself while it’s pumping money into the economy to try to make Obama look like an economic genius. #2) The money creation continues throughout Obama’s presidency, helping to counter Obama’s disastrous economic policies that spur job losses and sharply reduced corporate earnings. #3) Donald J. Trump is sworn in as president. Immediately, the Fed initiates its plan to crash the economy under Trump. #4) Beginning in early 2018, the Fed begins contracting its balance sheet, destroying the “wealth effect” it had created under Obama, as a way to harm the economy under Trump. #5) In September of 2019, the Fed reverses course and decides to return to pumping artificial money into the economy. #6) This is the inflection point where the Fed decides to start pumping money into the system to support Trump’s re-election. A Trump victory is virtually assured as long as the stock market doesn’t crash. Rest of story ... Lastly, we are of course in an irrational market bubble that will one day suffer a catastrophic correction, wiping out trillions in fictional “assets” that investors currently think are real. It looks like the Fed is trying to make sure that day of reckoning does not occur until after the 2020 election. If they can prop up the system for that long, it points to an early 2021 market crash Seems like it's from the time / money printed to bail out Freddie Mac & Fannie Mae Don't think world economy can stand another jolt 2008 size. |

|

|

|

|

|

Edited by

Let'sDoThis

on

Sun 12/15/19 02:57 PM

|

|

|

About the same time GovernmentMotors was bailed out.

They took the money and moved to Mexico. Japans Nissan did great with Cash for Clunkers. Easy for the manipulators to crash the market. |

|

|

|

|